How Many Hours Do You Need To Work Per Week To Get Health Insurance?

In the USA having a job which offers health insurance is a big deal - healthcare ain't cheap. Usually you'll need to work a certain number of hours per week though. Let's dig into it...

Knowing that you have access to high-quality, affordable healthcare is a major concern for workers all around the world. Unfortunately, access to health insurance is sometimes limited by the number of hours you work in a week.

Many part-time employees are excluded from employer-sponsored healthcare by the Affordable Care Act in the United States and similar legislation is other countries. In light of this, it's no surprise that many employees worry that a switch to a 4-day work week will impact their ability to access the health insurance they rely on.

In this article, we'll be breaking down how working fewer hours can affect your access to health insurance, both in the United States and internationally.

Let's get started!

Would you like a 4 day work week?

How Many Hours is Considered Full Time for Health Insurance?

A key point is that full-time status for health insurance varies by country. In many countries, your employer or the government provides health insurance, independent of how many hours you work. However, in the United States, full-time status, defined as working 30 or more hours weekly, is a requirement for employer-provided health insurance under the Affordable Care Act (ACA).

Let's dig more into how it works in the United States:

The United States

In the United States, full-time employment for health insurance purposes is defined as working 30 or more hours per week, as mandated by the Affordable Care Act (ACA). Luckily, this limit is less than the 32 hours that 4-day week employees typically get to work per week.

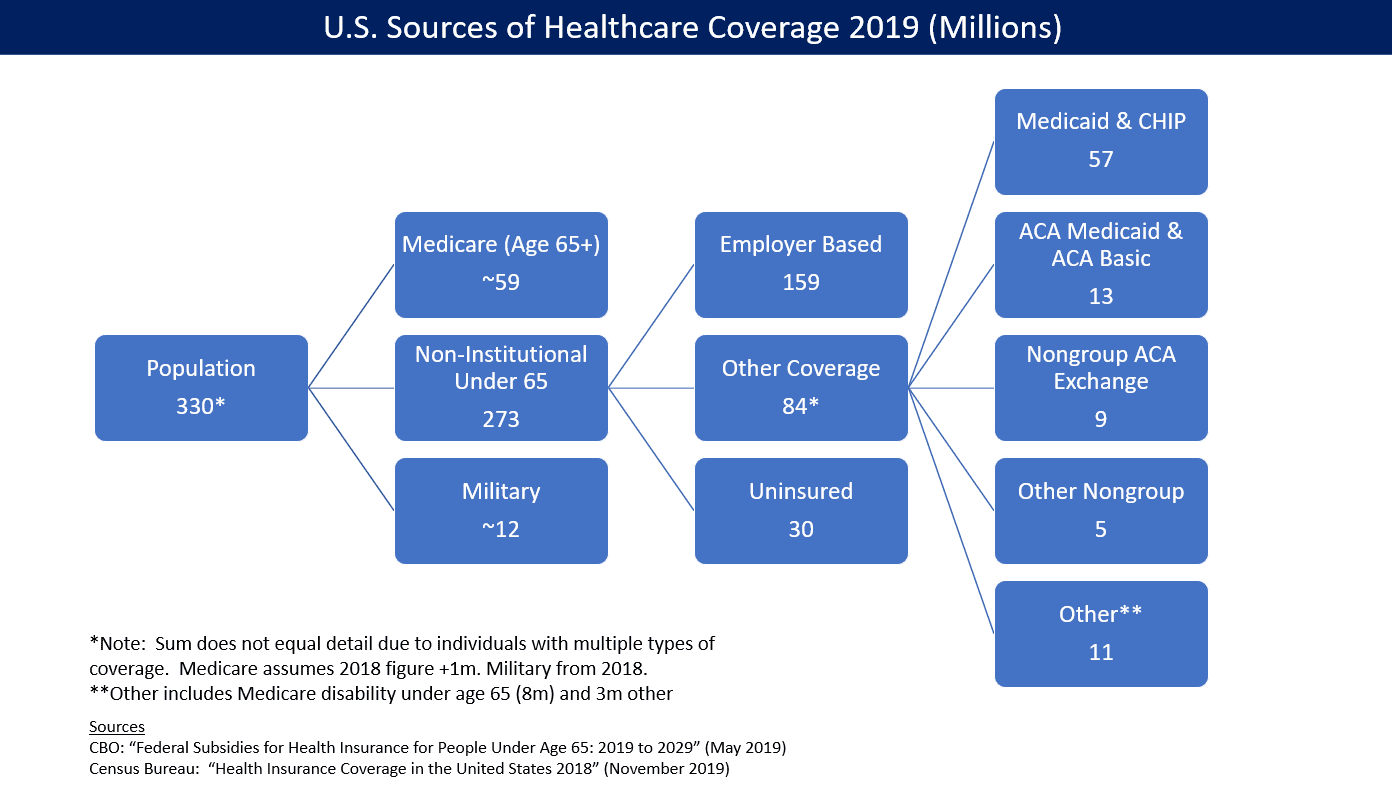

This means that if you work fewer than 30 hours per week in the USA, your employer is not required to offer you health insurance under the ACA. However, this does not mean that you will not be able to get health insurance—it simply means that you will have to obtain it in another way.

The good news is that there are a number of other ways to get health insurance if you work fewer than 30 hours per week in the USA. For example, you may be eligible for:

- Medicaid: This government-sponsored health insurance program is available to low-income individuals and families. You can learn more about Medicaid here.

- COBRA: This program allows you to keep your employer-sponsored health insurance for a limited time after leaving your job. You can learn more about COBRA here.

- Individual Health Insurance: This is health insurance that you purchase yourself, rather than getting it through an employer. You can learn more about individual health insurance here.

- Medicare: This is a government-sponsored health insurance program for seniors and people with certain disabilities. You can learn more about Medicare here.

If you work fewer than 30 hours per week in the USA and your employer does not offer health insurance, you have a few different options for obtaining coverage. Medicaid, COBRA, individual health insurance, and Medicare are all viable options that you can explore.

Exceptions in the United States

A US company isn't required to offer health insurance to workers who work less than 30 hours per week, but some companies still choose to do so. Some examples include:

- Starbucks – One of the most famous companies for offering benefits to part-timers, Starbucks provides health insurance for those who work at least 20 hours per week.

- UPS – The United Parcel Service offers health insurance to its part-time employees, though the specifics can vary by position.

- Costco – This wholesale retailer is known for its good benefits package for part-time employees.

- Lowe’s – Part-time employees at this home improvement retailer are eligible for limited health plans.

- Whole Foods (now owned by Amazon) – The grocery store chain provides health insurance to its part-time employees, but the minimum hour requirement might vary.

- REI – The outdoor retailer offers a benefits package to its part-time staff that includes health insurance.

- Staples – Some part-time employees at this office supplies retailer can qualify for health benefits.

- Nike – The sportswear giant provides benefits for eligible part-time employees.

- Macy’s – This department store chain offers some level of health insurance to its part-time staff, though the details can vary.

- Kaplan – The education company provides some part-time employees with health insurance options.

- JPMorgan Chase – Part-time staff at this bank can qualify for medical benefits, depending on their role and location.

- Land’s End – The clothing retailer provides health benefits to qualified part-time employees.

- Aetna – As a healthcare company, Aetna offers health insurance benefits to some of its part-time staff.

Additionally, some states have their own laws that require employers to offer health insurance to workers who work fewer than 30 hours per week. For example, in New Jersey, any business with 2-50 employees that offers a health insurance plan must offer that plan to all employees who work more than 25 hours per week.

Internationally

Like we mentioned earlier, getting access to employee health insurance is much easier in many other countries around the world thanks to government sponsored, universal healthcare. In these countries, your ability to get health insurance is not dependent on how many hours you work per week.

Some examples of countries with universal healthcare include:

- The European Union

- United Kingdom

- China

- Canada

- Russia

- Australia

- New Zealand

- India

- South Africa

- Bahrain

- Brunei

- Cyprus

- Hong Kong

- Iceland

- Israel

- Japan

- Kuwait

- Norway

- Singapore

- South Korea

- Switzerland

- United Arab Emirates

It's important to note that, while the number of hours you work per week does not directly impact your ability to get health insurance in most countries, it can still indirectly impact your ability to get coverage.

For example, if you work fewer hours, you may be less likely to qualify for certain government-sponsored health insurance programs. Additionally, if you work fewer hours, you may also have a lower income, which can make it more difficult to afford private health insurance.

Summary

Globally, the definition of full-time work for health insurance varies. In several countries, the number of hours you work each week doesn't directly affect your eligibility for health insurance, unlike in the United States where working 30 hours or more per week is typically considered full-time for health insurance purposes.

In the United States, you need to work at least 30 hours per week in order to qualify for employer-sponsored health insurance. However, there are a number of other ways to get health insurance if you work fewer than 30 hours per week in the USA, such as Medicaid, COBRA, individual health insurance, or Medicare.

4 Day Week is on a mission to educate employees and employers about the benefits of working a 4-day week. Head over to our blog to learn more about the 4-day workweek movement!